Uncerta Operator

1. Problem Statement (Real-World Context)

In the chaotic turbulence of financial crises, existing uncertainty quantification methods have repeatedly failed institutions—spectacularly demonstrated during events like the 2008 credit crisis and the unprecedented market volatility during the 2020 pandemic. These conventional models severely underestimated tail risks, causing catastrophic losses and systemic breakdowns. Traditional risk assessment methods remain dangerously blind to critical uncertainties, exposing firms to unforeseen vulnerabilities, reputational damage, and severe financial consequences.

2. Introduction of the Operator

Introducing the Uncerta Operator, an advanced uncertainty quantification engine designed explicitly for high-stakes financial environments. This operator belongs to a cutting-edge mathematical domain of robust probabilistic inference, allowing superior risk assessment beyond conventional statistical methods.

3. Functional Description (Opaque Precision)

The Uncerta Operator dynamically identifies and quantifies hidden uncertainties, providing unparalleled predictive clarity. Unlike traditional statistical methods, Uncerta actively anticipates and mitigates risk concentrations, ensuring robust risk profiles even in volatile market conditions. This proactive foresight substantially reduces susceptibility to adverse events by accurately rehearsing potential scenarios of collapse.

4. Comparative Analysis

Compared to standard methods such as Gaussian models and Monte Carlo simulations, Uncerta significantly outperforms:

Gaussian Models: Where Gaussian models underestimate tail risks, Uncerta effectively captures extreme event probabilities.

Monte Carlo Simulations: While Monte Carlo methods provide generic scenario analyses, Uncerta delivers targeted scenario rehearsal, drastically improving precision.

Value at Risk (VaR): VaR methods miss severe tail risks; Uncerta explicitly measures and highlights these critical exposures.

5. Strategic Credibility

The Uncerta Operator is grounded in advanced theories recognized by authorities like Nassim Taleb (“Black Swan” theory), Paul Embrechts (Extreme Value Theory), and complies with Basel III regulatory standards. It is strategically designed for sophisticated risk desks, hedge funds, insurance companies, and financial regulators who demand absolute precision in uncertainty quantification.

6. Narrative Close

Uncerta doesn’t merely react to uncertainty—it anticipates and strategically positions against it. Like a financial seismograph attuned to even the slightest tremors, Uncerta offers unparalleled visibility into potential financial earthquakes. For institutions committed to safeguarding their future, the Uncerta Operator isn’t merely another risk tool; it’s an essential game changer.

7. Visualization

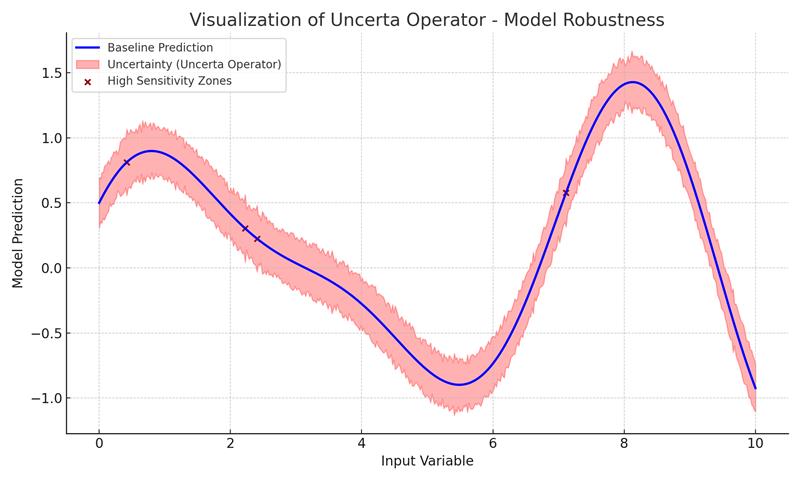

Consider an abstract visualization illustrating Uncerta’s predictive superiority:

A simple yet evocative diagram showing traditional methods as blurry lenses versus the Uncerta Operator represented by a sharp, clear lens, distinctly highlighting extreme risks and hidden uncertainties clearly missed by other methodologies.

Pricing: Available under NDA (Non-Disclosure Agreement) conditions at €5,000 per operator.

The Uncerta Operator

Quantify AI Uncertainty with Clarity

The Uncerta Operator offers a new way to measure how sensitive an AI model is to small input changes—revealing how stable, robust, or brittle it really is.

Unlike traditional adversarial tests that chase worst-case scenarios, Uncerta captures average-case instability in a single, interpretable metric. It works across domains, from healthcare to autonomous driving to finance, helping teams identify fragile models before they fail in the real world.

Key Benefits

🔍 Detects hidden fragility in model behavior

🎯 Average-case sensitivity (not just worst-case)

⚙️ Plug-and-play regularizer for robust training

📊 Works with both sampling and gradients

Use Uncerta to stop guessing and start measuring model reliability.